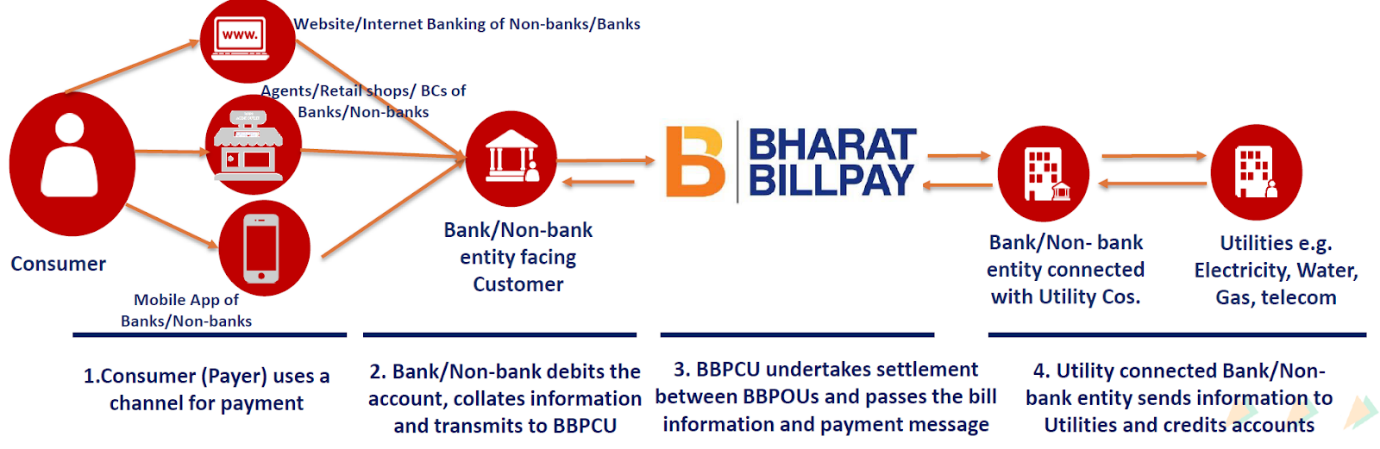

BBPS (Bharat BillPay System) is an interoperable network of billers and payer apps. National Payments Council of India operates this scheme with the approval from RBI.

Merchants can connect to an omni-channel network of UPI Apps (PhonePe, GooglePay), net banking portals, mobile banking, ATM/ Kiosks and physical locations like bank branches, business correspondents, agent kiosks, all with a single integration. There are 400+ digital apps and 3.5 million offline locations across India where customers can pay bills.

Think about how you pay utility bills - electricity, water, gas, DTH recharge? You open any mobile app of choice, find the 'biller', input the customerID, and complete the payment within minutes. This is now expanded to non-utility categories, such as:

- Loan Repayments

- Credit Card

- Mutual Fund

- Insurance

- Cable

- Housing Society

- Subscription Fees (eg OTT)

- Educational Fees (School/College/Pvt. Institutions)

- Municipal Taxes

Setu enables you to enlist one such 'biller' under the given categories. Collecting through this channel can improve efficiency and drastically reduce the cost of collections.

Pricing and operating guidelines have been provided by NPCI for each category.

More information on BBPS can be found here BBPS | Explainer | Basic FAQs on BBPS

Source: NPCI

Network participation: Billers | Payers

Additional Reading:

RBI’s Final Guidelines on Bharat Bill Payment System

NPCI Bharat BillPay Procedural Guidelines

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article